Reporter Yu Na from China Industry Daily

On July 20-21, 2023, the China Petrochemical Industry High Quality Development Conference was held in Panjin, Liaoning. At the meeting, experts, scholars, and business representatives at the conference offered suggestions and suggestions on how to achieve high-quality development in the petrochemical industry.

▲ Fu Xiangsheng

Fu Xiangsheng, Deputy Secretary and Vice President of the Party Committee of the China Petroleum and Chemical Industry Federation, stated that the transformation and upgrading of the traditional petrochemical industry should be accelerated, and products should be promoted towards high-end, refined, and differentiated development; At the same time, we will accelerate the digital transformation of traditional industries and improve production efficiency and enterprise competitiveness through pilot demonstrations such as smart factories and smart chemical parks.

90 types of bulk chemical products are experiencing a price decline

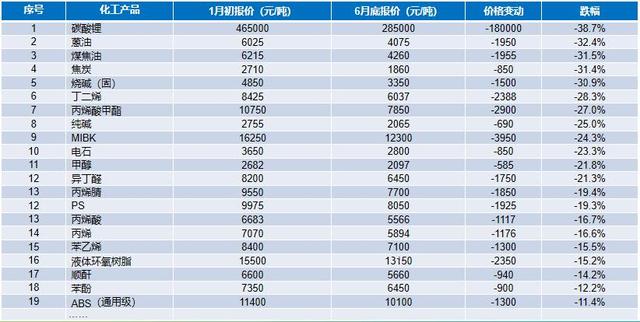

Since the beginning of this year, a total of 90 out of 108 bulk chemical products have experienced price declines.

Among them, chemical products such as lithium carbonate, coal tar, coke, and caustic soda experienced a decline of over 30%; Chemicals such as butadiene, soda ash, MIBK, methanol, and isobutyraldehyde have experienced a decline of over 20%; More than 30 chemical products such as propylene, maleic anhydride, phenol, and ABS have experienced a decline of over 10%. Taking liquid epoxy resin as an example, in November 2021, its quotation reached 41000 yuan/ton; In June 2023, the quotation was only 13150 yuan/ton, showing a cliff like decline.

Price changes of bulk chemical products from January to June 2023

The decline in crude oil prices has a significant impact on the prices of chemical products, leading to the loss of high price support for chemical products and thus compressing the profitability of enterprises. At the same time, overcapacity has also become an important issue facing the current chemical industry, which not only intensifies market competition but also further drives down product prices. Many chemical enterprises have adopted measures such as shutdown for maintenance and reducing load to cope with the situation.

▲ Bai Ming

Bai Ming, a foreign trade expert and second level researcher of the Economic and Trade Policy Expert Committee of the Ministry of Commerce, analyzed the international trade environment faced by China's petrochemical industry. He believes that geopolitical conflicts have a significant impact on international commodity markets. From the supply side perspective, Russia and Ukraine are currently the world's major commodity exporting countries, and many countries heavily rely on importing commodities from both countries. From the demand side perspective, the slowdown of the Chinese economy has had a chilling effect on international commodity prices. From a financial perspective, as the Federal Reserve exits its quantitative easing monetary policy and enters a rate hike cycle, international market speculation on commodities will gradually cool down.

"The high-quality development of the petrochemical industry still faces many challenges. In terms of scale, China is already a true petrochemical country, but in terms of technological level and competitiveness, it is not yet a strong country, and there are still obvious gaps and shortcomings. For example, the dependence on crude oil for many years has exceeded 70%, and the shortcomings of weak innovation capabilities have become increasingly apparent. Structural contradictions have not been fundamentally changed. Due to the high proportion of coal chemical industry in China's petrochemical industry, the carbon emissions in the process of using coal as raw material to produce chemicals or synthetic oil products are much higher than those of natural gas and oil as raw materials. In the process of implementing the 'dual carbon' strategy, the pressure and challenges are even more severe." Fu Xiangsheng analyzed.

Effectively reducing oil and increasing chemical production in refining equipment

What is the overall development trend of the petrochemical industry in the coming years?

▲ Yang Ting

Yang Ting, Secretary General of the Chemical Industry Park Working Committee of the China Petroleum and Chemical Industry Federation, stated in a speech titled "Qianlong in the Abyss - Outlook for the Development of China's Petrochemical Industry in 2025" that it is expected that by 2025, the country's crude oil processing capacity will reach 980 million tons per year, and the average scale of refineries will be further improved. The consumption of refined oil products in China is expected to reach its peak from 2027 to 2028, and the transformation of refineries to increase production of chemical raw materials has become an inevitable development trend for Chinese refining enterprises, with a clear trend of reducing oil and increasing chemical production.

In terms of ethylene industry, China currently presents a "three part world" production pattern. Among them, Sinopec's total ethylene production capacity is 15.03 million tons/year (including joint ventures), accounting for 32% nationwide; The total ethylene production capacity of central enterprises such as PetroChina and CNOOC is 14.15 million tons/year, accounting for 30% of the national total; The total ethylene production capacity of other operating entities is 18.32 million tons/year, accounting for 38% of the national total.

"It is expected that by 2025, the total ethylene production capacity in China will be about 66 million tons per year, with a production capacity of 58 million tons calculated based on an 88% operating rate. Calculated based on an average annual growth rate of 5.2%, it is expected that China's ethylene equivalent demand will be about 70 million tons by 2025, with a shortfall of about 12 million tons. Sinopec's ethylene production capacity will reach 20.33 million tons per year, accounting for 30.8%; the total ethylene production capacity of central enterprises such as PetroChina will reach 22.15 million tons per year, accounting for 33.6%; and the total production capacity of other enterprises will account for 35.6%." Yang Ting predicts.

In terms of aromatics industry, currently, PX (p-xylene, one of the important aromatic compounds) in China is still in the peak period of capacity expansion. In 2022, the production capacity has increased nearly three times that of 2015, and the self-sufficiency rate has rapidly increased, shifting from heavy dependence on imports to self-sufficiency. In 2022, the overall demand of PX industrial chain will be weak due to geopolitical conflict, aromatics oil transfer, COVID-19 and other factors.

"It is expected that in 2023, the domestic supply capacity of xylene will continue to improve, the share of imported goods will continue to decrease, and the profit margin of xylene will also decrease. In the future, it will return to cost pricing (naphtha+processing fee pricing)." Yang Ting analyzed.

Yang Ting believes that the integration of reducing oil and increasing chemical production, petroleum material utilization, and deep refining with chemical as the main focus will be the major development direction of the petrochemical industry.

In response, Fu Xiangsheng reminded that refining equipment should do a good job of "reducing oil and increasing chemical content". To reduce fuel consumption, it is necessary to reasonably regulate gasoline, coal, and diesel, minimize diesel production, moderately produce gasoline, and reasonably produce more aviation coal and low sulfur ship fuel. "Increasing production" requires refining and chemical facilities to produce as much olefins as possible. Relevant industrial policies require that by 2025, the production rate of refined oil from newly built integrated refining and chemical facilities should be controlled below 40%. For integrated refining and chemical plants that have already been put into operation, sufficient utilization of by-product light hydrocarbon raw materials should be made, and it is also possible to consider supplementing a small amount of naphtha or light hydrocarbon resources to produce more olefins and strengthen downstream chain extension, replenishment, and strengthening.

"We should also grasp the trend of raw material lightweighting in the refining industry. For example, new technologies for directly producing chemicals from light crude oil can be used in the refining process, as well as propane dehydrogenation to produce propylene and ethane cracking to produce ethylene for light olefin raw materials. Compared with traditional naphtha cracking processes, they have shorter processes, lower costs, and are also the cleanest process, with obvious competitive advantages." Fu Xiangsheng said.

▲ Xu Chunming

Xu Chunming, an academician of the CAS Member and director of the National Key Laboratory of Heavy Oil at China University of Petroleum, suggested that we should not only pay attention to "reducing oil and increasing chemicals", but also "reducing oil and increasing specialty" and "reducing oil and increasing materials". "Reducing oil and increasing specialty" should pay attention to lubricating oil products, special asphalt, etc; "Reducing oil and adding materials" should pay attention to needle coke, carbon fiber, etc.

The trend of industrial park clustering is obvious

Compressing the cost of the entire industry chain to the extreme, forming a significant cost advantage, a group of world-class chemical enterprises and chemical parks are accelerating to emerge in China.

Data shows that as of now, there are a total of 643 national key chemical parks or industrial parks dominated by petroleum and chemical industries (593 chemical parks have been announced by various provinces, and some provinces and cities have not yet announced the list of chemical parks), of which 67 are national level chemical parks (including park in park parks located in national economic and technological development zones, high-tech zones, bonded zones, and new areas).

In 2022, the operating revenue of the petroleum and chemical industry was 16.56 trillion yuan, and the output value of the chemical park was about 8.45 trillion yuan, accounting for approximately 51% of the total industry output value. "It is expected that by 2025, the output value of the chemical industry park will be 13.5 trillion yuan, accounting for more than 70% of the industry's total output value. From 2022 to 2025, the annual compound growth rate of the output value of the chemical industry park will remain above 16.9%." Yang Ting predicts.

Fu Xiangsheng suggested that high attention should be paid to the development of industrial clusters. Industrial clustering is an inevitable choice to promote the revitalization of China's economic development and reach a new level. The petrochemical industry should learn from and draw on the practices and experiences of world-class petrochemical bases such as Jurong Island, Ludwigshafen Port, Antwerp, and Jubail Industrial City. It should focus on the development of bases, large-scale equipment, integrated refining and chemical industries, and industrial clusters. In accordance with the overall goal of cultivating the "five major world-class petrochemical industry clusters", it should aim at the advanced level of world-class petrochemical bases. On the basis of doing a good job in smart and green parks, it should strengthen innovation, highlight industrial chain collaboration and industrial cluster cultivation, and also benchmark low-carbon parks and even "zero carbon parks" to create high-quality development demonstration parks.

▲ Yang Kai

In the petrochemical industry cluster around Bohai Bay, Panjin Liaobin Coastal Economic and Technological Development Zone (hereinafter referred to as "Liaobin Economic and Technological Development Zone") has obvious advantages. According to Yang Kai, Vice Chairman of the Panjin Municipal Political Consultative Conference and Secretary of the Party Working Committee of the Panjin Liaobin Coastal Economic and Technological Development Zone Management Committee, it is expected that by the end of the 14th Five Year Plan, the Liaobin Economic and Technological Development Zone will achieve a regional GDP of 50 billion yuan, a petrochemical industry output value of 300 billion yuan, a refining capacity of 30 million tons/year, an ethylene production capacity of 2.65 million tons/year, a xylene production capacity of 2 million tons/year, a synthetic resin production capacity of 4 million tons/year, and a synthetic rubber production capacity of 240000 tons/year, striving to build a first-class chemical park in China.

▲ Du Bingguang

As a key project of Liaobin Economic Development Zone, the Weapon/Amei Fine Chemical and Raw Material Engineering Project has a total investment of up to 83.7 billion yuan. According to Du Bingguang, Vice Chairman of Huajin Group, the fine chemical and raw material engineering project is a comprehensive strategic cooperation project jointly promoted by the heads of state of China and Saudi Arabia. It is an important component of Ordnance Industry Group's efforts to build a petroleum and petrochemical industry chain and build a billion dollar petrochemical industry base. The project construction includes 32 sets of process units, including 15 million tons/year oil refining, 1.65 million tons/year ethylene, 2 million tons/year PX, as well as supporting public works and auxiliary facilities. After completion and operation, it is expected to achieve an annual operating income of 100 billion yuan and a profit of over 10 billion yuan, making it a leading and world-class petrochemical and fine chemical industry base in China.

"Saudi Aramco has made the necessary investment as agreed in the agreement; the process package design and foundation design have been completed; the procurement of long-term equipment is accelerating; and the construction of on-site pile foundations, roads, and main ground pipes is progressing in an orderly manner." Du Bingguang revealed the latest progress of the project. It is reported that the project started construction comprehensively on March 29th of this year. The total construction period of the project is 30 months, and it is planned to be mechanically completed in September 2025 and put into operation in the first half of 2026.

▲ Wang Sanming

It is worth mentioning that many enterprises are building a new generation of smart chemical parks based on the industrial Internet platform. According to Wang Sanming, Chairman of Anyuan Technology Co., Ltd., the Qiye Cloud Industrial Internet platform built by Anyuan Technology can build a new generation of intelligent chemical park overall framework; Gathering enterprise safety production data, on-site data of public areas in the park, and data from various related business systems to form a big data resource pool in the park; Realize intelligent control such as monitoring and early warning, intelligent control, emergency linkage, command and dispatch, and carry out hidden danger management.

Reviewed by: Yu Zao Zao

Editor in Chief: Huo Yue

Editor: Hu Na

+86 10-64730110

+86 10-64730100